This is how you do it

This is how you do it

If you have visited the Netherlands and done a lot of shopping, you may be eligible for a tax (VAT) refund. The tax refund partners at Schiphol will help you arrange this quickly and easily. You can find out how below.

We are testing a new app to make tax refunds even easier. If you make purchases at one of the participating stores, you may be invited to take part in the pilot. Will you help us test the new app? You can find all the information about requesting a tax refund here.

You can request a tax refund if you meet the following criteria:

To get a tax refund, the first thing you need to do is fill in the tax-free form. You can request this form at the checkouts of participating shops. Complete the form and attach the original receipt. Not all shops are affiliated with the same tax refund partner, so you may need to complete several tax-free forms. Once you have done this, bring all forms with you to Schiphol.

Please note: in order to claim a tax refund, you must show your unused goods at customs. Only after that can you open the packaging and use your purchases.

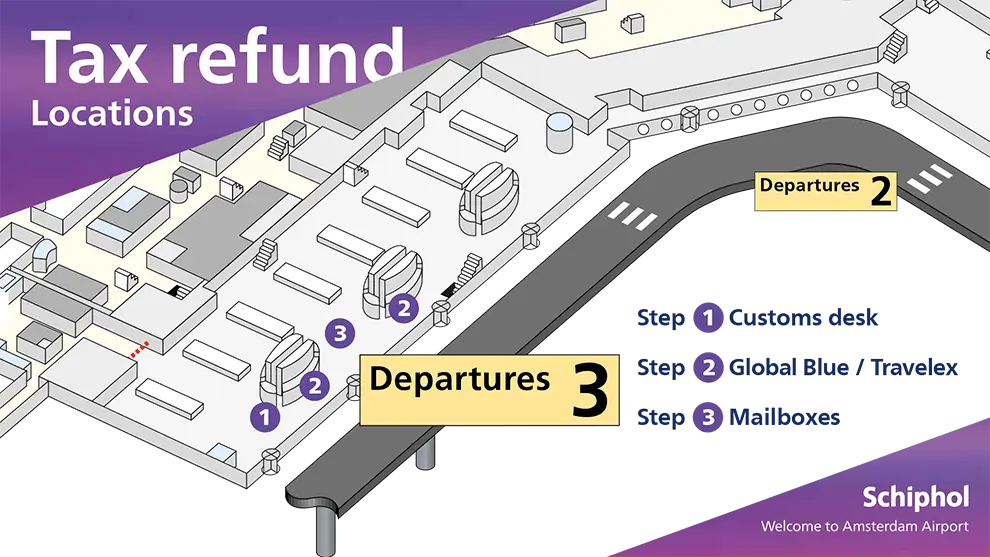

Arrive at the airport on time on the day of your flight and make sure you have enough time to visit two or more tax refund desks to make your claim(s). You can find these desks in Departure Hall 3. The map below shows their exact location.

Step 1: get customs stamps

Take your tax-free form with original receipt attached and your purchases to the customs desk at the airport. Remember to bring your passport and flight details too. If approved, you will receive a stamp on the form. You will need these to request your VAT back through the tax refund partner(s).

Step 2: collect your money

Would you like your VAT refunded right away? Bring the stamped tax-free form(s) to the tax refund partner's desk that is affiliated with the shop(s) where you made your purchases. At Schiphol, this will either be the Global Blue desk or the Travelex desk. Travelex handles tax refunds for Planet and Innova.

OR step 3: receive a credit card refund

You can choose to have a credit card refund, which is perhaps handy if you are in a hurry. If you go for this option, you can simply put your completed and stamped tax-free form(s) in a special Global Blue, Planet or Innova mailbox. The amount will be automatically credited to your credit card within a few weeks.

If you would like to know which shops are connected to which tax refund partner, please check the relevant partner’s website, look for one of the tax-free shopping logos below at the shop entrances or ask a member of staff at the checkout.

Check the opening hours and locations at the top of this page.